GROWING PAINS

The Four Phases of Business Growth

Read more

GROWING PAINS

The Four Phases of Business Growth

Read more

The Four Phases of Business Growth: A Guide for Startups

Business Strategy

|

2024

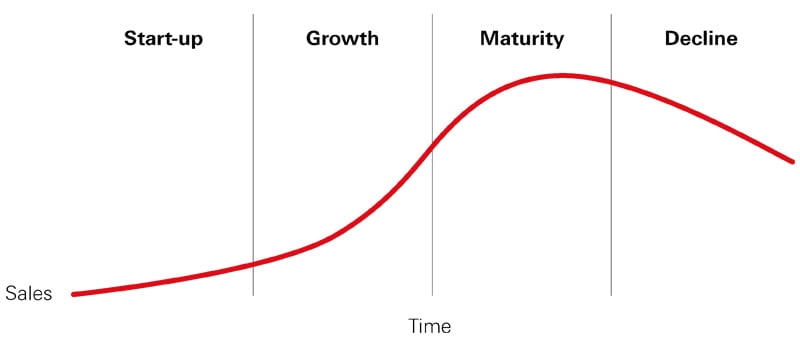

Sound financial management is critical at every stage of your company's lifecycle. Here, we break down the four phases of business:

Start-Up

High Growth

Maturity

Decline

Whether you’re just starting out or looking to maintain your market position, understanding the different phases of business will help you navigate challenges and capitalize on opportunities.

Phase 1: Start-Up

The start-up phase is often the most challenging period for new businesses. Entrepreneurs are driven by a strong vision and high motivation but typically face significant financial and operational hurdles. Key characteristics of this phase include:

Lack of Initial Capital: Start-ups often struggle with securing sufficient funding, relying heavily on personal savings, loans from family and friends, and credit.

Poor or Nonexistent Cash Flow: With limited sales and high initial costs, maintaining positive cash flow is a constant battle.

Inexperienced Management: Founders may lack experience in running a business, leading to trial-and-error decision-making.

Poor or Nonexistent Financial Information: Accurate financial tracking and planning are often underdeveloped, making it hard to make informed decisions.

This "wonder" phase is marked by high stress and long hours, with survival often in question. Despite these challenges, financial analysis and planning are crucial.

Developing a realistic cash flow forecast and identifying break-even points can help secure funding and guide decisions. Persistence, resourcefulness, and sound financial management are key to surviving the start-up phase.

Phase 2: Growth

If you navigate through the start-up phase successfully, your business may enter a period of high growth. This phase is exciting but challenging, characterized by:

Rapid Revenue Growth: Rapid expansion brings increased revenue, but also higher operational demands.

Strained Capital: Even profitable businesses can face cash flow issues, requiring additional funding to sustain growth.

Negative Operating Cash Flow: Investment in inventory, personnel, and expansion often outpaces incoming cash.

Transition to Formal Management: Shifting from informal, reactive management to structured, proactive strategies is necessary.

Better Financial Information: Improved financial reporting and analysis become possible and necessary.

This "blunder" phase requires careful management to avoid pitfalls like excessive debt and poor decision-making. Cash flow remains a challenge despite growing profits, and the reliance on debt increases financial risk.

Entrepreneurs often struggle to move from informal management to a structured approach, leading to mistakes that can jeopardize the business. Avoiding these pitfalls requires sound financial management and strategic advice to ensure sustainable growth.

Phase 3: Maturity

Reaching the maturity phase is a significant milestone. Your business is now stable, profitable, and has a solid market presence. Key characteristics include:

Access to Capital: Cash reserves and increased borrowing power enable reinvestment in growth and risk mitigation.

Stable Profitability: Reliable profits improve forecasting accuracy and ensure operational stability.

Positive Cash Flow: Consistently positive cash flow allows for debt reduction and reinvestment in the business.

Experienced Management: A seasoned management team provides strategic direction.

Accurate Financial Information: Detailed financial data supports informed decision-making.

This "thunder" phase allows you to reap the rewards of your hard work. cash flow is positive, debts are paid down, and the business reaps the rewards of previous efforts. However, staying at the top requires vigilance.

To avoid complacency, continuous improvement and strategic reinvestment are critical. A robust financial strategy transforms your strong position into a springboard for future growth.

Phase 4: Decline

The decline phase can be challenging as businesses face reduced growth and profitability. Common characteristics include:

Substantial Capital: While still financially robust, resources may be underutilized.

Strong but Declining Cash Flow: Revenue streams diminish as market share decreases.

Solid but Declining Growth and Profitability: Growth slows, and profitability wanes.

Complacent, Detached Ownership: Risk aversion and resistance to change can hinder innovation.

Adversity to Risk: Conservative strategies limit opportunities for revitalization.

This "plunder" phase often leads to decline unless proactive steps are taken. Risk aversion shifts the focus to preserving assets rather than pursuing new opportunities, leading to stagnation. Meanwhile, intensifying competition from younger, more aggressive companies erodes market share.

It’s crucial to recognize this phase early and consider strategies such as revitalizing the business, transitioning to new leadership, or selling the business to an experienced operator. Injecting fresh energy and ideas is crucial for the business's long-term health.

Navigating Your Business Phase

Identifying your current phase of business is crucial to applying the right financial strategies. Each stage requires different approaches to management, cash flow, and growth strategies.

By aligning your financial practices with your business phase, you can navigate challenges more effectively and position your company for long-term success. Whether you are just starting out or looking to maintain your market position, financial clarity is necessary for success.

For personalized advice and strategies tailored to your business's unique needs, contact the experts at White Collar Combat. We help you navigate every phase of your business journey with confidence and competence.

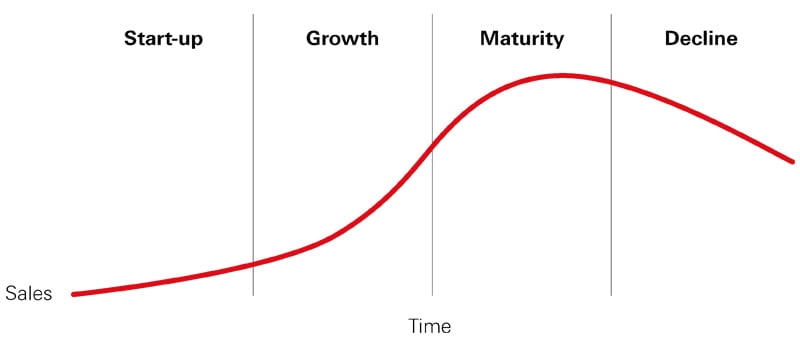

Sound financial management is critical at every stage of your company's lifecycle. Here, we break down the four phases of business:

Start-Up

High Growth

Maturity

Decline

Whether you’re just starting out or looking to maintain your market position, understanding the different phases of business will help you navigate challenges and capitalize on opportunities.

Phase 1: Start-Up

The start-up phase is often the most challenging period for new businesses. Entrepreneurs are driven by a strong vision and high motivation but typically face significant financial and operational hurdles. Key characteristics of this phase include:

Lack of Initial Capital: Start-ups often struggle with securing sufficient funding, relying heavily on personal savings, loans from family and friends, and credit.

Poor or Nonexistent Cash Flow: With limited sales and high initial costs, maintaining positive cash flow is a constant battle.

Inexperienced Management: Founders may lack experience in running a business, leading to trial-and-error decision-making.

Poor or Nonexistent Financial Information: Accurate financial tracking and planning are often underdeveloped, making it hard to make informed decisions.

This "wonder" phase is marked by high stress and long hours, with survival often in question. Despite these challenges, financial analysis and planning are crucial.

Developing a realistic cash flow forecast and identifying break-even points can help secure funding and guide decisions. Persistence, resourcefulness, and sound financial management are key to surviving the start-up phase.

Phase 2: Growth

If you navigate through the start-up phase successfully, your business may enter a period of high growth. This phase is exciting but challenging, characterized by:

Rapid Revenue Growth: Rapid expansion brings increased revenue, but also higher operational demands.

Strained Capital: Even profitable businesses can face cash flow issues, requiring additional funding to sustain growth.

Negative Operating Cash Flow: Investment in inventory, personnel, and expansion often outpaces incoming cash.

Transition to Formal Management: Shifting from informal, reactive management to structured, proactive strategies is necessary.

Better Financial Information: Improved financial reporting and analysis become possible and necessary.

This "blunder" phase requires careful management to avoid pitfalls like excessive debt and poor decision-making. Cash flow remains a challenge despite growing profits, and the reliance on debt increases financial risk.

Entrepreneurs often struggle to move from informal management to a structured approach, leading to mistakes that can jeopardize the business. Avoiding these pitfalls requires sound financial management and strategic advice to ensure sustainable growth.

Phase 3: Maturity

Reaching the maturity phase is a significant milestone. Your business is now stable, profitable, and has a solid market presence. Key characteristics include:

Access to Capital: Cash reserves and increased borrowing power enable reinvestment in growth and risk mitigation.

Stable Profitability: Reliable profits improve forecasting accuracy and ensure operational stability.

Positive Cash Flow: Consistently positive cash flow allows for debt reduction and reinvestment in the business.

Experienced Management: A seasoned management team provides strategic direction.

Accurate Financial Information: Detailed financial data supports informed decision-making.

This "thunder" phase allows you to reap the rewards of your hard work. cash flow is positive, debts are paid down, and the business reaps the rewards of previous efforts. However, staying at the top requires vigilance.

To avoid complacency, continuous improvement and strategic reinvestment are critical. A robust financial strategy transforms your strong position into a springboard for future growth.

Phase 4: Decline

The decline phase can be challenging as businesses face reduced growth and profitability. Common characteristics include:

Substantial Capital: While still financially robust, resources may be underutilized.

Strong but Declining Cash Flow: Revenue streams diminish as market share decreases.

Solid but Declining Growth and Profitability: Growth slows, and profitability wanes.

Complacent, Detached Ownership: Risk aversion and resistance to change can hinder innovation.

Adversity to Risk: Conservative strategies limit opportunities for revitalization.

This "plunder" phase often leads to decline unless proactive steps are taken. Risk aversion shifts the focus to preserving assets rather than pursuing new opportunities, leading to stagnation. Meanwhile, intensifying competition from younger, more aggressive companies erodes market share.

It’s crucial to recognize this phase early and consider strategies such as revitalizing the business, transitioning to new leadership, or selling the business to an experienced operator. Injecting fresh energy and ideas is crucial for the business's long-term health.

Navigating Your Business Phase

Identifying your current phase of business is crucial to applying the right financial strategies. Each stage requires different approaches to management, cash flow, and growth strategies.

By aligning your financial practices with your business phase, you can navigate challenges more effectively and position your company for long-term success. Whether you are just starting out or looking to maintain your market position, financial clarity is necessary for success.

For personalized advice and strategies tailored to your business's unique needs, contact the experts at White Collar Combat. We help you navigate every phase of your business journey with confidence and competence.

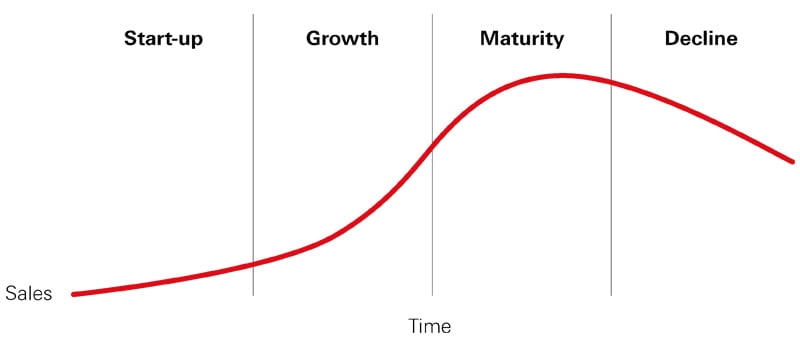

Sound financial management is critical at every stage of your company's lifecycle. Here, we break down the four phases of business:

Start-Up

High Growth

Maturity

Decline

Whether you’re just starting out or looking to maintain your market position, understanding the different phases of business will help you navigate challenges and capitalize on opportunities.

Phase 1: Start-Up

The start-up phase is often the most challenging period for new businesses. Entrepreneurs are driven by a strong vision and high motivation but typically face significant financial and operational hurdles. Key characteristics of this phase include:

Lack of Initial Capital: Start-ups often struggle with securing sufficient funding, relying heavily on personal savings, loans from family and friends, and credit.

Poor or Nonexistent Cash Flow: With limited sales and high initial costs, maintaining positive cash flow is a constant battle.

Inexperienced Management: Founders may lack experience in running a business, leading to trial-and-error decision-making.

Poor or Nonexistent Financial Information: Accurate financial tracking and planning are often underdeveloped, making it hard to make informed decisions.

This "wonder" phase is marked by high stress and long hours, with survival often in question. Despite these challenges, financial analysis and planning are crucial.

Developing a realistic cash flow forecast and identifying break-even points can help secure funding and guide decisions. Persistence, resourcefulness, and sound financial management are key to surviving the start-up phase.

Phase 2: Growth

If you navigate through the start-up phase successfully, your business may enter a period of high growth. This phase is exciting but challenging, characterized by:

Rapid Revenue Growth: Rapid expansion brings increased revenue, but also higher operational demands.

Strained Capital: Even profitable businesses can face cash flow issues, requiring additional funding to sustain growth.

Negative Operating Cash Flow: Investment in inventory, personnel, and expansion often outpaces incoming cash.

Transition to Formal Management: Shifting from informal, reactive management to structured, proactive strategies is necessary.

Better Financial Information: Improved financial reporting and analysis become possible and necessary.

This "blunder" phase requires careful management to avoid pitfalls like excessive debt and poor decision-making. Cash flow remains a challenge despite growing profits, and the reliance on debt increases financial risk.

Entrepreneurs often struggle to move from informal management to a structured approach, leading to mistakes that can jeopardize the business. Avoiding these pitfalls requires sound financial management and strategic advice to ensure sustainable growth.

Phase 3: Maturity

Reaching the maturity phase is a significant milestone. Your business is now stable, profitable, and has a solid market presence. Key characteristics include:

Access to Capital: Cash reserves and increased borrowing power enable reinvestment in growth and risk mitigation.

Stable Profitability: Reliable profits improve forecasting accuracy and ensure operational stability.

Positive Cash Flow: Consistently positive cash flow allows for debt reduction and reinvestment in the business.

Experienced Management: A seasoned management team provides strategic direction.

Accurate Financial Information: Detailed financial data supports informed decision-making.

This "thunder" phase allows you to reap the rewards of your hard work. cash flow is positive, debts are paid down, and the business reaps the rewards of previous efforts. However, staying at the top requires vigilance.

To avoid complacency, continuous improvement and strategic reinvestment are critical. A robust financial strategy transforms your strong position into a springboard for future growth.

Phase 4: Decline

The decline phase can be challenging as businesses face reduced growth and profitability. Common characteristics include:

Substantial Capital: While still financially robust, resources may be underutilized.

Strong but Declining Cash Flow: Revenue streams diminish as market share decreases.

Solid but Declining Growth and Profitability: Growth slows, and profitability wanes.

Complacent, Detached Ownership: Risk aversion and resistance to change can hinder innovation.

Adversity to Risk: Conservative strategies limit opportunities for revitalization.

This "plunder" phase often leads to decline unless proactive steps are taken. Risk aversion shifts the focus to preserving assets rather than pursuing new opportunities, leading to stagnation. Meanwhile, intensifying competition from younger, more aggressive companies erodes market share.

It’s crucial to recognize this phase early and consider strategies such as revitalizing the business, transitioning to new leadership, or selling the business to an experienced operator. Injecting fresh energy and ideas is crucial for the business's long-term health.

Navigating Your Business Phase

Identifying your current phase of business is crucial to applying the right financial strategies. Each stage requires different approaches to management, cash flow, and growth strategies.

By aligning your financial practices with your business phase, you can navigate challenges more effectively and position your company for long-term success. Whether you are just starting out or looking to maintain your market position, financial clarity is necessary for success.

For personalized advice and strategies tailored to your business's unique needs, contact the experts at White Collar Combat. We help you navigate every phase of your business journey with confidence and competence.

Contact

© White Collar Combat 2024

Contact

© White Collar Combat 2024

Contact

© White Collar Combat 2024